| “We still think rates are on a gradual path downward… how much further we go becomes a closer call” | The BoE Governor recently warned about the impact AI could exert on employment | ONS statistics show retail sales volumes fell 0.1% in November, below analysts’ expectations |

Pace of rate cuts could slow further

While the latest set of consumer price statistics did show inflation now sitting at an eight-month low, after cutting interest rates to their lowest level in almost three years, the Bank of England (BoE) warned further reductions were likely to become a ‘closer call.’

Data published last month by the Office for National Statistics (ONS) revealed that the annual headline CPI rate of inflation fell to 3.2% in November. This reading was below all economists’ predictions in a Reuters poll, with the consensus suggesting the rate would only dip marginally from October’s figure of 3.6% to 3.5%.

ONS said that lower food prices were a key driver behind November’s fall, with notable decreases seen in the cost of cakes, biscuits and breakfast cereals. Heavier Black Friday discounts compared to last year, particularly in the clothing and footwear sector, also helped drive the inflation rate lower.

November’s CPI data enhanced hopes that inflation has now peaked as well as strengthening the case for an immediate interest rate cut; and the BoE’s Monetary Policy Committee (MPC) duly obliged when announcing the decision of its latest deliberations a day after the consumer price data had been released.

However, as expected, the decision was a tight call with the nine-member committee only voting by a 5-4 majority to reduce rates by 0.25 percentage points, taking Bank Rate down to 3.75%. Additionally, despite acknowledging that the risk from ‘greater inflation persistence’ has become ‘somewhat less pronounced,’ the minutes to the meeting did suggest that the already gradual pace of monetary easing may be about to slow further.

Commenting after announcing the MPC’s decision, BoE Governor Andrew Bailey reiterated this latter point saying, “We still think rates are on a gradual path downward but with every cut we make, how much further we go becomes a closer call.”

Survey reports modest upturn in growth

Although gross domestic product (GDP) figures released last month showed the UK economy unexpectedly contracted in October, more recent survey evidence does point to a potential return to growth at the end of last year.

Official GDP statistics published by ONS revealed that UK output declined by 0.1% in October, following a similar-sized fall in September and zero growth in August. Overall, this resulted in the economy shrinking by 0.1% across the whole of the August-to-October period.

October’s decline surprised economists who had typically been expecting a 0.1% rise. The weaker-than-anticipated figure was partly due to manufacturing output failing to recover as had been hoped, as repercussions from the Jaguar Land Rover cyber-attack continued to affect car production in October. Additionally, analysts suggested that uncertainty ahead of the Chancellor’s Budget had affected growth, negatively impacting both consumer and business spending levels.

Data from the latest S&P Global UK Purchasing Managers’ Index (PMI), however, suggests businesses do now appear to be emerging from months of Budget speculation and fears of tax increases, with the survey’s preliminary headline growth indicator rising to 52.1 in December. This reading was up from 51.2 in November and above all forecasts submitted in a Reuters poll of economists.

Commenting on the findings, S&P Global Market Intelligence’s Chief Business Economist Chris Williamson said December’s data brought “welcome news on faster economic growth” at the end of 2025, with firms buoyed by “the post-Budget lifting of uncertainty.” The PMI data, he said, was consistent with GDP growth of 0.2% in December and 0.1% across the fourth quarter as a whole, although he did add a note of caution, saying that growth was still dependent on technology and financial services activity, with “many other parts of the economy struggling to grow or in decline.”

Markets

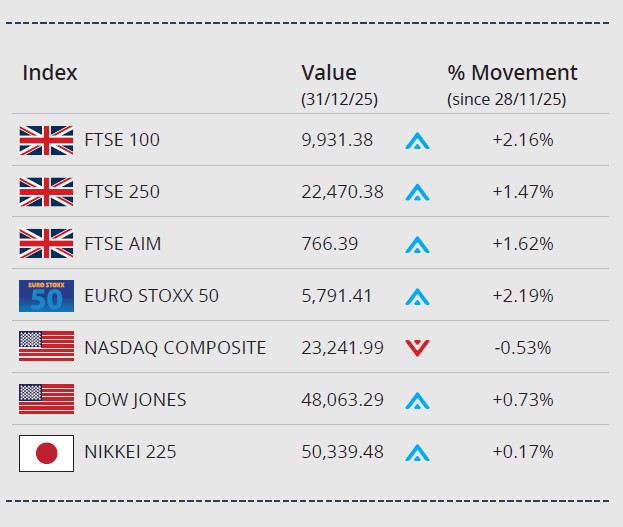

Although major global indices closed 2025 higher year-on-year, trading at month end was mixed, with many markets closing lower on the last day of the year.

On home shores, the blue-chip FTSE 100 closed the year on 9,931.38 to register an annual increase of over 21%, its strongest annual percentage increase since 2009. The mid cap FTSE 250 ended the year over 8.9% higher on 22,470.38 and the FTSE AIM rose over 6.4% to close the year on 766.39. Despite periods of geopolitical and macroeconomic uncertainty, UK equities were supported by gains across several heavyweight sectors.

In the US, the tech-heavy NASDAQ climbed around 20% in the year to close on 23,241.99, while the Dow Jones closed up around 13% on 48,063.29. Despite global tariff uncertainty, a government shutdown and concerns over an AI bubble, robust corporate earnings, interest rate cuts and continued AI enthusiasm provided support.

On the continent the Euro Stoxx 50 closed the year over 18% higher on 5,791.41. In Japan, the Nikkei 225 ended the year on 50,339.48, gaining over 26% in 2025.

On the foreign exchanges, the euro closed the year at €1.14 against sterling. The US dollar closed at $1.34 against sterling and at $1.17 against the euro.

Gold closed the year trading around $4,337 a troy ounce, an annual gain of over 60%. One of the strongest performing assets of the year. Brent Crude closed the year at around $61 a barrel, recording an annual loss of over 18%, as global surplus pressures markets.

Governor warns AI likely to displace jobs

The latest batch of labour market statistics has provided further evidence of a weakening jobs market, while the BoE Governor recently warned about the impact artificial intelligence (AI) could exert on employment.

Figures released by ONS last month showed the UK unemployment rate rose to 5.1% in the August-to-October period; this represents the highest figure since the start of 2021. The data also highlighted the impact on younger workers, with the number of unemployed 18 to 24-year-olds increasing by 85,000 in the three months to October, the largest rise on this metric since November 2022.

The release also revealed a further fall in employee numbers, with estimates suggesting the total number of payrolled employees fell by 38,000 in November following a drop of 22,000 in October. Data from S&P Global’s UK PMI also reported further cutbacks to staffing numbers in December with job losses reported to be ‘worryingly widespread.’

Last month also saw the Governor of the BoE warn that widespread adoption of AI is likely to displace people from jobs in a similar manner as during the Industrial Revolution. Mr Bailey also highlighted a specific issue for younger professionals who could find it difficult to secure entry-level roles due to AI.

Retail trading conditions remain tough

Official retail sales figures revealed an unexpected dip in sales volumes during November, while more recent survey data shows the retail environment remains challenging despite some improvement in consumer morale.

ONS statistics released last month showed retail sales volumes fell by 0.1% in November; this was below analysts’ expectations, with a Reuters poll predicting a 0.4% rise. ONS noted that supermarket sales fell for a fourth consecutive month, while retailer discounts across November failed to boost Black Friday spending by as much as in some recent years.

Evidence from the latest CBI Distributive Trades Survey also suggests retailers endured ‘softer trading conditions’ in the run-up to Christmas. Additionally, the CBI said retailers were not anticipating ‘any relief in the new year,’ with sales expectations deteriorating to their weakest level in over four years.

December’s GfK Consumer Confidence index did offer retailers a glimmer of hope, with the long-running survey’s headline sentiment figure edging up to its joint-highest level of the year. GfK Director Neil Bellamy, however, acknowledged that confidence remains subdued describing consumers as “a family on a festive winter hike, crossing a boggy field – plodding along stoically, getting stuck in the mud and hoping that easier conditions are not far off.”

All details are correct at the time of writing (02 January 2026)

The value of investments can go down as well as up and you may not get back the full amount you invested. The past is not a guide to future performance and past performance may not necessarily be repeated.

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for information only. We cannot assume legal liability for any errors or omissions it might contain. No part of this document may be reproduced in any manner without prior permission.